Many people who are thinking about a nose operation ask the very same question early on.

“Does insurance cover rhinoplasty?”

The answer is not that simple, and it depends largely on why the procedure is being performed. As you probably know, insurance rarely (almost never) pays for cosmetic changes alone. However, it may as well cover a part or even the entire rhinoplasty procedure, but there has to be a clear medical reason.

Understanding how insurers evaluate rhinoplasty will help you set realistic expectations and avoid unpleasant surprises.

A nationwide analysis found that insurance reimbursement for primary rhinoplasty varies significantly by plan type and that out-of-pocket costs can differ widely, highlighting the financial burden patients may face even when seeking surgery; this underscores how insurance coverage depends on plan specifics rather than purely on cosmetic versus medical classification.

Understanding Rhinoplasty: Medical vs. Cosmetic Purposes

Rhinoplasty is a medical procedure that can serve two very different purposes.

The first is cosmetic. Here, the goal is to change the appearance of the nose.

The second is medical, and in this instance, surgery is performed to improve breathing or correct structural problems.

A nose job that is done purely to enhance appearance is usually classified as a cosmetic procedure. In contrast, if the surgery is performed to restore airflow or correct internal abnormalities, this will probably be labelled as medically necessary.

There are some very specific procedures that can address both appearance and function, and this means that the outcome can be cosmetically and functionally beneficial at the same time.

Here’s a quick table that outlines the difference clearly.

Aspect | Medical Rhinoplasty | Cosmetic Rhinoplasty |

Primary purpose | Improve breathing and nasal function | Change the appearance of the nose |

Main goal | Restore normal airflow and support | Enhance shape, size, or proportions |

Typical indication | Breathing problems or structural defects | Aesthetic preference |

Common conditions | Deviated septum, nasal valve collapse, obstruction | Hump removal, tip refinement, symmetry |

Impact on breathing | Yes, directly addresses airflow | No functional improvement usually |

Insurance coverage | Often covered if medically necessary | Not covered by insurance |

Documentation required | Medical exams, imaging, symptom history | Not required |

Procedure focus | Internal nasal structures | External appearance of the nose |

Can be combined | Yes, with cosmetic adjustments | Sometimes combined with medical repair |

When Will Insurance Cover Rhinoplasty?

Your insurance provider will generally pay only when rhinoplasty is required for medical reasons. Insurers will evaluate whether the surgery is essential to restore normal function to the patient and prevent ongoing health issues in these types of cases.

So, if the documentation shows that the condition is affecting the patient’s breathing or sleep, or anything that disrupts the overall health of the patient, then some insurance plans can partially or fully approve the coverage. You also need to remember that approval never happens automatically. You cannot say that your insurance covers rhinoplasty that easily.

Each case is reviewed by insurance companies individually, and their decisions are based on medical evidence rather than the patient’s preferences.

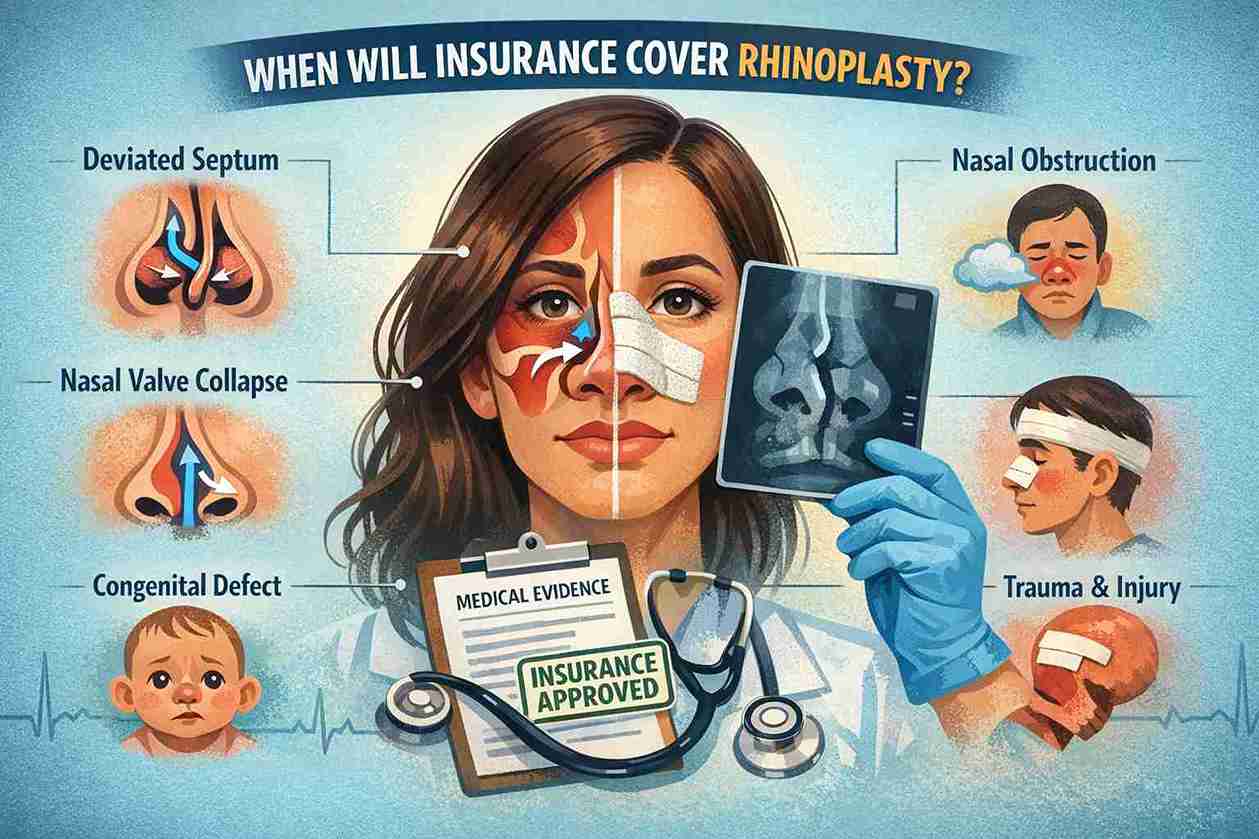

Common Medical Conditions That May Qualify for Coverage

Several medical conditions can actually justify insurance approval. As mentioned, this happens when rhinoplasty is required to correct them. Let’s go over the most common ones.

Deviated Septum

A deviated septum is something that happens when the wall that separates the nostrils is somehow displaced, and this condition can affect one or both airways in the nostrils. As a result, the nostrils are narrowed. In severe cases, it can obstruct airflow and contribute to breathing difficulties.

Nasal Obstruction

Chronic nasal blockage that does not respond to medication can also qualify as a medical condition. Obstruction often affects the nasal passages, and it can interfere with daily breathing, which will definitely have a negative effect on the patient’s quality of life.

Nasal Valve Collapse

A nasal valve collapse is a structural weakness that causes the airway to narrow during inhalation. It is a recognized functional condition that will probably require surgical corrections to bring things back to normal.

Congenital Defects

Some people are born with structural abnormalities that have a negative effect on the nose and breathing. In such instances, when these defects actually impair breathing, surgery can be considered medically necessary.

Trauma and Injury

Injuries from accidents or certain kinds of sports-related injuries can damage the patient’s nasal structures, and this can lead to long-term breathing issues. Such a scenario will probably justify a surgical procedure that will be covered by insurance.

Insurance Requirements and Documentation

If you want your insurance approved as fast as humanly possible, then you need to get the right documentation. Medical records should clearly demonstrate that the procedure is a medical necessity. It should include symptoms, failed non-surgical treatments, and other diagnostic findings.

You should prepare reports from imaging studies, breathing tests, and evaluations by qualified specialists. Medical insurers want proof that your surgery is not optional but rather necessary to restore function and prevent further complications such as chronic sinus infections.

How to Get Pre-Authorization for Rhinoplasty

Pre-authorization is a very important step for most insurers. This process involves submitting medical documentation before you schedule your surgery.

Then, a board certified facial plastic surgeon will typically prepare and submit the request, outlining why the procedure is needed. These approval timelines are different depending on several factors, but clear and complete documentation improves the chances of success. Patients are encouraged to schedule a consultation early because that will give them time to understand whether insurance approval is realistic in their specific case.

What Costs Are Typically Covered by Insurance?

An approved insurance plan can cover the cost of fixing functional components with surgery. This can include correcting a deviated septum, stabilizing nasal valves, or repairing internal damage that affects airflow.

Coverage often applies only to the medically necessary portion of the scheduled rhinoplasty in Turkey. Hospital fees, anesthesia related to functional correction, and surgeon fees can also be included, but this depends on your policy.

What Costs Are Not Covered?

Purely cosmetic changes are almost never covered. This includes aesthetic reshaping that does not improve function.

Fees related to cosmetic refinement, surgeon artistry, or optional enhancements are typically excluded. Patients should expect to pay out-of-pocket for any part of plastic surgery that is not considered medically necessary.

Expense Type | Usually Covered |

Functional correction | Yes |

Diagnostic tests | Often |

Hospital fees | Sometimes |

Cosmetic reshaping | No |

FAQs

Does insurance ever cover cosmetic rhinoplasty?

No. Insurance does not cover rhinoplasty performed solely for appearance. Cosmetic-only procedures are excluded from coverage.

How do I know if my rhinoplasty is considered medically necessary?

A medical evaluation is required. If plastic surgeons document functional impairment and failed non-surgical treatments, insurance may consider coverage.

Will insurance cover a deviated septum and rhinoplasty together?

In short, yes, but only in some cases. Insurers might approve insurance coverage for functional rhinoplasty while excluding cosmetic portions.

How long does insurance approval take for rhinoplasty?

Approval can take several weeks, depending on the insurer and the completeness of documentation.